Hi, I am trying to enter a formula that automatically works out dividend tax but it doesn't always work.

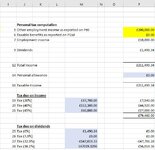

For example, when taxable income is £210,000 and dividends are £1,490.34 this is what shows in the cells:

The formulas are:

M25 =+IF(P9<2000,P9,2000)

M26 =+IF(P16<37700,P9-M25,IF(M19=37700,0,P9-(37000-M25)))

M27 =+IF(P16<37700,0,IF(P16<150000,P9-M25-M26,IF(M20=150000,0,P9-(150000-M26-M25)))

M28 =+IF(P16<150000,0,P9-M27-M26-M25)

I want to be able to change the taxable income and it change the dividend tax rate automatically but not sure what I am doing wrong?

The first £2,000 of dividends are not taxable

If there is any basic rate band left from taxable income, the next amount of dividends up to the top of that band (up to £37,700) are taxed at 7.5%

If the dividends go over the basic rate band (or taxable income is between £37700 and £150k), the next (up to) £112,300 is taxed at 32.5%

If dividends take this over £150k, the balance is taxed at 38.1%

Thanks

Natalie

For example, when taxable income is £210,000 and dividends are £1,490.34 this is what shows in the cells:

The formulas are:

M25 =+IF(P9<2000,P9,2000)

M26 =+IF(P16<37700,P9-M25,IF(M19=37700,0,P9-(37000-M25)))

M27 =+IF(P16<37700,0,IF(P16<150000,P9-M25-M26,IF(M20=150000,0,P9-(150000-M26-M25)))

M28 =+IF(P16<150000,0,P9-M27-M26-M25)

I want to be able to change the taxable income and it change the dividend tax rate automatically but not sure what I am doing wrong?

The first £2,000 of dividends are not taxable

If there is any basic rate band left from taxable income, the next amount of dividends up to the top of that band (up to £37,700) are taxed at 7.5%

If the dividends go over the basic rate band (or taxable income is between £37700 and £150k), the next (up to) £112,300 is taxed at 32.5%

If dividends take this over £150k, the balance is taxed at 38.1%

Thanks

Natalie

Attachments

Last edited: