I am getting different IRRs when using your values (rounded to nearest whole number) and my values which include decimals. Again, so strange that such small differences would throw off IRR so wildly???

I agree that it is strange. But now I can explain what is happening. See below. But first, some pointers for future reference, if I may....

Thank you so much for reposting the unrounded numbers with greater precision (9 decimal places). That was sufficient for me to reproduce the problem.

But in general, it would be better to

choose a number of decimal places so that the smallest number is displayed with 15 signficant digits. In this case, that would be 10 decimal places, because the magnitude of the smallest number is an integer with 5 digits.

(Caveat TMI.... FYI, even 15 significant digits might not be sufficient for us to reproduce the exact internal binary values. And in rare cases, that can make a difference. So it would be ideal to add a parallel column with calculations of the form

=A1-(A1&"") formatted as Scientific. That displays the infinitesimal difference between the internal binary value and decimal approximation up to 15 significant digits, which is all that Excel formats. But arguably, that might be too much trouble, and it is usually unnecessary. Just thought you might like to know.)

Re: ``Apologies for not posting the Excel originally, but I am having troubling figuring out how to do that``. That is understandable. But at the very least, you should

copy-and-paste formulas from the Formula Bar, as I did. Caveat: When we do that, we lose the curly braces around array-entered formulas.

So it would be prudent to either type the curly braces after pasting the formula into the posting, or at least indicating that a formula had been indeed array-entered.

Finally, again, it is useful to

indicate the row and column labels of the cells. At the very least, indicate the cell label for the upper-left corner.

-----

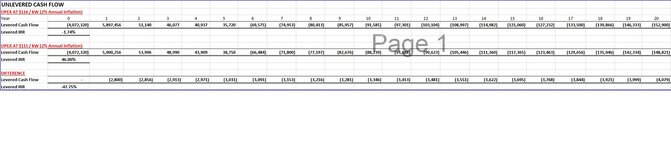

Okay, let's explain your problem, if not solve it....

The root cause of the inconsistencies is: your cash flows have 2 IRRs(!).

That is not unusual for such "unrealistic"(?) cash flows. Recall that I was suspicious of the magnitude of the cash flow in year 1 relative to the other cash flows. And I am even more suspicious of the fact that the first and last cash flows have the same sign.

Later, I was able to "rationalize" it. But on second thought, I suspect that my rationalize does not fit the reality of your data.

Bottom line: Eventually, the "real solution" might be to have a discussion about the cash flow model itself. But let's put a pin in that for now, and focus on the mechanics of the IRR calculation.

So returning to the issue of 2 IRRs....

When the results of Excel IRR (or XIRR or RATE) surprise me, I generate a table of the "NPV curve"; that is, the NPV of the cash flows with various discount rates. For example:

Note: Click on cells or hover the cursor over them to see formulas. Also, note the XL2BB scrollbar on the far right.

Note that in all cases, there are sign changes between the

same pairs of rates for both rounded and unrounded cash flows. Specifically, between -10% and zero; and between 40% and 50%.

So we might try "guesses" of -5% and 45%. The results are demonstrated below.

| Book1 |

|---|

|

|---|

| A | B | C | D | E | F |

|---|

| 1 | | Unrounded Cash Flows | | Rounded Cash Flows |

|---|

| 2 | | OpEx@115 | OpEx@116 | | OpEx@115 | OpEx@116 |

|---|

| 3 | IRR(B8:B28) | -2.09% | 45.77% | | 46.00% | 45.77% |

|---|

| 4 | IRR(B8:B28,-5%) | -2.09% | -1.74% | | -2.09% | -1.74% |

|---|

| 5 | IRR(B8:B28,45%) | 46.00% | 45.77% | | 46.00% | 45.77% |

|---|

| 6 | | | | | | |

|---|

| 7 | Year | | | | | |

|---|

| 8 | 0 | -4,072,320.0000000000 | -4,072,320.0000000000 | | -4072320 | -4072320 |

|---|

| 9 | 1 | 5,900,256.3034917500 | 5,897,456.3034917500 | | 5900256 | 5897456 |

|---|

| 10 | 2 | 53,995.7688516040 | 51,139.7688516040 | | 53996 | 51140 |

|---|

| 11 | 3 | 48,989.9288516040 | 46,076.8088516040 | | 48990 | 46077 |

|---|

| 12 | 4 | 43,908.5868516040 | 40,937.2044516040 | | 43909 | 40937 |

|---|

| 13 | 5 | 38,750.4166316040 | 35,719.6065836040 | | 38750 | 35720 |

|---|

| 14 | 6 | -66,484.0127145960 | -69,575.4389635560 | | -66484 | -69575 |

|---|

| 15 | 7 | -71,799.9172547380 | -74,953.1720286780 | | -71800 | -74953 |

|---|

| 16 | 8 | -77,196.7787027710 | -80,413.0985721890 | | -77197 | -80413 |

|---|

| 17 | 9 | -82,676.0249130240 | -85,956.6711798300 | | -82676 | -85957 |

|---|

| 18 | 10 | -88,239.1103840740 | -91,585.3695762160 | | -88239 | -91585 |

|---|

| 19 | 11 | -93,887.5167725010 | -97,300.7011484870 | | -93888 | -97301 |

|---|

| 20 | 12 | -99,622.7534167350 | -103,104.2014802400 | | -99623 | -103104 |

|---|

| 21 | 13 | -105,446.3578711710 | -108,997.4348959460 | | -105446 | -108997 |

|---|

| 22 | 14 | -111,359.8964507860 | -114,981.9950160570 | | -111360 | -114982 |

|---|

| 23 | 15 | -117,364.9647864460 | -121,059.5053230220 | | -117365 | -121060 |

|---|

| 24 | 16 | -123,463.1883911140 | -127,231.6197384220 | | -123463 | -127232 |

|---|

| 25 | 17 | -129,656.2232371950 | -133,500.0232114490 | | -129656 | -133500 |

|---|

| 26 | 18 | -135,945.7563452100 | -139,866.4323189490 | | -135946 | -139866 |

|---|

| 27 | 19 | -142,333.5063840470 | -146,332.5958772610 | | -142334 | -146333 |

|---|

| 28 | 20 | -148,821.2242830110 | -152,900.2955660890 | | -148821 | -152900 |

|---|

|

|---|

Note that we get consistent results in rows 4 and 5 for both rounded and unrounded cash flows.

We get inconsistent results only with the default "guess" (10%) in row 3.

(Aside.... Interestingly, not only are the default results inconsistent between rounded and unrounded cash flows; but also, they are inconsistent between your version of Excel and mine(!). The latter inconsistencies really might be due to the fact that I am working with cash flows that are rounded to 14 significant digits in some cases, whereas you are working with the exact internal binary values.)

You might ask: why does the precision of the values cause Excel IRR to find different IRRs?

The simple answer is: we cannot know, since the internal Excel implementation is proprietary.

But in general, the mathematical methods for finding the IRR(s) are very fragile, regardless of the implmentation details, especially for cash flows like yours.

Does that explain things sufficiently?