-

If you would like to post, please check out the MrExcel Message Board FAQ and register here. If you forgot your password, you can reset your password.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

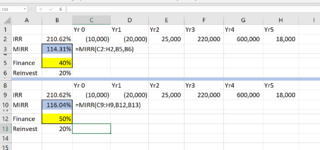

MIRR is going higher with a higher Finance rate, but it should not. Why is this?

- Thread starter VDawg

- Start date

Excel Facts

Copy a format multiple times

Select a formatted range. Double-click the Format Painter (left side of Home tab). You can paste formatting multiple times. Esc to stop

StephenCrump

MrExcel MVP

- Joined

- Sep 18, 2013

- Messages

- 5,398

- Office Version

- 365

- Platform

- Windows

Welcome to the Forum!

The calculation is correct.

MIRR is based on the ratio of FV(returns on investment at the reinvestment rate) to NPV(cost of funding the investment at the funding rate), as shown below:

For an investor with a given funding cost, and a given reinvestment rate (or rates), MIRR can be used to evaluate the returns on different investments.

You are correct that if an investor has a higher funding cost, a given amount of finance will cost more to repay. But that's not what the MIRR is measuring.

The calculation is correct.

MIRR is based on the ratio of FV(returns on investment at the reinvestment rate) to NPV(cost of funding the investment at the funding rate), as shown below:

| A | B | C | D | E | F | G | H | |||

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0 | 1 | 2 | 3 | 4 | 5 | ||||

| 2 | IRR | 210.62% | -10,000 | -20,000 | 25,000 | 220,000 | 600,000 | 18,000 | ||

| 3 | ||||||||||

| 4 | Finance | 50% | ||||||||

| 5 | Reinvest | 20% | ||||||||

| 6 | ||||||||||

| 7 | NPV - Finance | -23,333 | -10,000 | -20,000 | ||||||

| 8 | FV - Reinvest | 1,098,000 | 0 | 0 | 25,000 | 220,000 | 600,000 | 18,000 | ||

| 9 | MIRR | 116.04% | ||||||||

| 10 | Check: | 116.04% | ||||||||

Sheet1 | ||||||||||

| Cell Formulas | ||

|---|---|---|

| Range | Formula | |

| B2 | B2 | =IRR(C2:H2) |

| B7 | B7 | =NPV(frate,C7:H7)*(1+frate) |

| B8 | B8 | =NPV(rrate,C8:H8)*(1+rrate)^(N+1) |

| B9 | B9 | =(-B8/B7)^(1/N)-1 |

| B10 | B10 | =MIRR(C2:H2,B4,B5) |

| Named Ranges | ||

|---|---|---|

| Name | Refers To | Cells |

| frate | =Sheet1!$B$4 | B10, B7 |

| N | =Sheet1!$H$1 | B8:B9 |

| rrate | =Sheet1!$B$5 | B10, B8 |

For an investor with a given funding cost, and a given reinvestment rate (or rates), MIRR can be used to evaluate the returns on different investments.

You are correct that if an investor has a higher funding cost, a given amount of finance will cost more to repay. But that's not what the MIRR is measuring.

Upvote

0

jorismoerings

Well-known Member

- Joined

- Jul 4, 2014

- Messages

- 1,523

- Office Version

- 365

- 2016

- 2013

- Platform

- Windows

Hi,

as addition to @StephenCrump

By increasing the finance rate, the cost of borrowing and the profit from interest will go up.

In your example the sum of negative cash flows is significantly lower as the sum of positive cash flows, the incurring of a higher cost on negative cash flows is outweighed by the interest on positive cashflows.

as addition to @StephenCrump

By increasing the finance rate, the cost of borrowing and the profit from interest will go up.

In your example the sum of negative cash flows is significantly lower as the sum of positive cash flows, the incurring of a higher cost on negative cash flows is outweighed by the interest on positive cashflows.

Upvote

0

Similar threads

- Question

- Replies

- 1

- Views

- 267

- Replies

- 0

- Views

- 236

- Replies

- 0

- Views

- 320

- Replies

- 2

- Views

- 154