Hey gang.

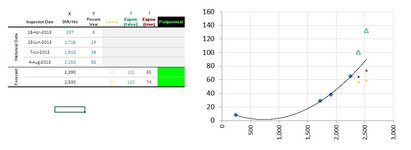

Excel can give us linear, exponential and polynomial trendlines.

To forecast unknown Ys based on known Xs, I've used

Excel can give us linear, exponential and polynomial trendlines.

To forecast unknown Ys based on known Xs, I've used

- for linear, =ROUND(FORECAST and the plot points perfectly land where Excel would have put them by adding a linear trendline

- for Exponential =GROWTH, and the plot points perfectly land where Excel would have put them by adding an exponential trendline (both for true and false)

- for polynomial (order 2), ...??