Hi

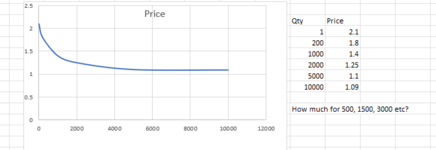

I'd like to put together some pricing for products, with lower prices for volume.

If plotted with volume on an X axis and price on Y, this would give me a curve a bit like the bottom left quarter of a flattened oval.

I don't have the maths skills to work out a formula that gives me the curve I want, where I can specify how steep it is, how quickly it bottoms out as we get near cost price etc. So my idea was to plot a curve in Excel using certain data points, and then extract the price from the curve by seeing if Excel could give me the values along its length.

I found some VBA code to extract data from a chart, but if only gives the values I've put in to my source data - it doesn't allow me to get the values in between, i.e. along the entire length of the curve.

Any suggestions please?

Thanks in advance

I'd like to put together some pricing for products, with lower prices for volume.

If plotted with volume on an X axis and price on Y, this would give me a curve a bit like the bottom left quarter of a flattened oval.

I don't have the maths skills to work out a formula that gives me the curve I want, where I can specify how steep it is, how quickly it bottoms out as we get near cost price etc. So my idea was to plot a curve in Excel using certain data points, and then extract the price from the curve by seeing if Excel could give me the values along its length.

I found some VBA code to extract data from a chart, but if only gives the values I've put in to my source data - it doesn't allow me to get the values in between, i.e. along the entire length of the curve.

Any suggestions please?

Thanks in advance