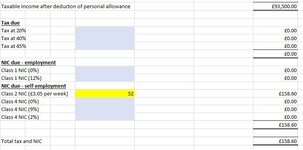

Hi all, I am a newbie to complex formulas in excel and I am trying to put together a tax and NIC calculator for 2020/21. I have searched formulas on different threads and most seem to give formulas based on calculating all of the tax due in one formula, rather than splitting it out into the different bands.

I am looking to put formulas into the below x cells:

Total taxable income Cell B6 (for example)

Tax at 20% x (to calculate the amount if income taxable at 20% - up to £37500) £ (tax due would then be calculated by multiplying x by 20%)

Tax at 40% x (to calculate the amount if income taxable at 40% - between £37501 and £150000) £ (tax due would then be calculated by multiplying x by 40%)

Tax at 45% x (to calculate the amount if income taxable at 45% - Income over £150000) £ (tax due would then be calculated by multiplying x by 45%)

Then the same for NIC using the NIC bands.

Is someone able to help me with the formula I need to put in to calculate the taxable/NICable income?

Thank you

Natalie

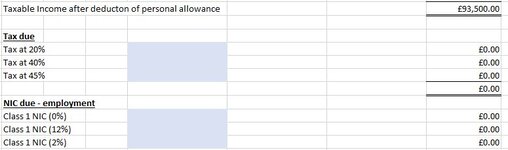

I am looking to put formulas into the below x cells:

Total taxable income Cell B6 (for example)

Tax at 20% x (to calculate the amount if income taxable at 20% - up to £37500) £ (tax due would then be calculated by multiplying x by 20%)

Tax at 40% x (to calculate the amount if income taxable at 40% - between £37501 and £150000) £ (tax due would then be calculated by multiplying x by 40%)

Tax at 45% x (to calculate the amount if income taxable at 45% - Income over £150000) £ (tax due would then be calculated by multiplying x by 45%)

Then the same for NIC using the NIC bands.

Is someone able to help me with the formula I need to put in to calculate the taxable/NICable income?

Thank you

Natalie