swilson2006

New Member

- Joined

- May 25, 2012

- Messages

- 11

Hi there

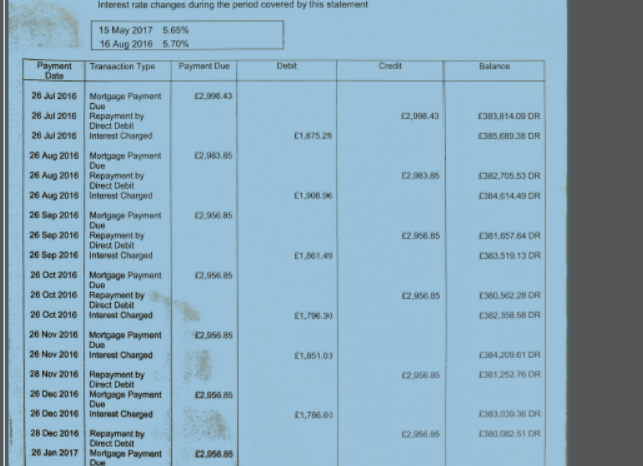

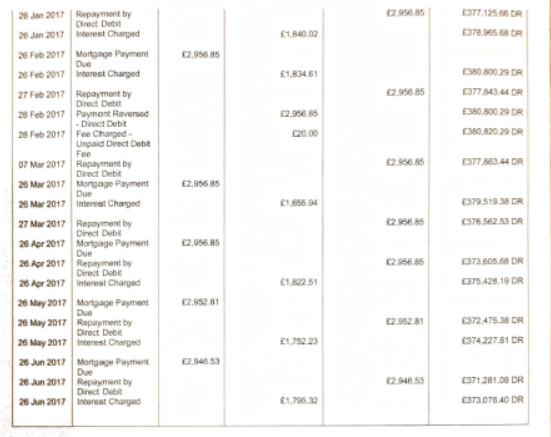

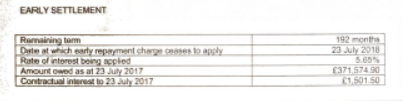

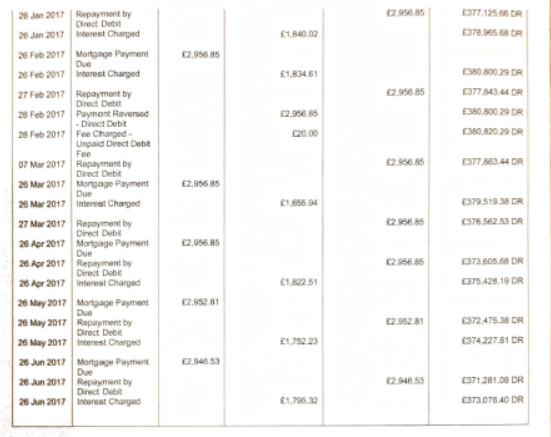

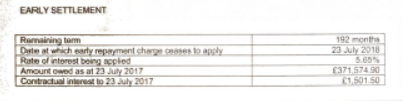

I cannot seem to get the mortgage/loan bank statement replicated in excel. Can someone please help? I think it has something to do with when they change rates based on the number of day. I think they use exact days.

You can see at the top of the statement the rates and the date they changed. This should be enough to calculate the repayments but I seem to be getting different repayments than those on the statement. The rate from 16 August 2016 is 5.70% and then 5.65% from May 2017. I want to exrapolate the statement till the end of payment but I cannot get the same payment and interest figures as they do.

I hope some expert on amortisation of loans can help.

Thanks so much. Much appreciated.

S

I cannot seem to get the mortgage/loan bank statement replicated in excel. Can someone please help? I think it has something to do with when they change rates based on the number of day. I think they use exact days.

You can see at the top of the statement the rates and the date they changed. This should be enough to calculate the repayments but I seem to be getting different repayments than those on the statement. The rate from 16 August 2016 is 5.70% and then 5.65% from May 2017. I want to exrapolate the statement till the end of payment but I cannot get the same payment and interest figures as they do.

I hope some expert on amortisation of loans can help.

Thanks so much. Much appreciated.

S

Last edited: