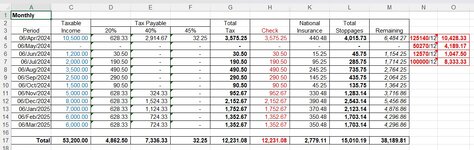

I thought I'd poke my nose in and add this. Note. All thresholds are based on 2023/24 tax year. Unless there's a policy change, there will be no changes before 2028.

Based on the formula to calculate the total tax

=MAX(MAX(I4-(U$4),0)*0.45+MIN(MAX(I4-(U$5),0),(U$4-U$5))*0.4+MIN(I4-(U$6),(U$5-U$6))*0.2+MAX((MIN(I4,(U$4))-(U$7))/2,0)*0.4,0)

[modified from the formula =MAX(MAX(A1-150000,0)*0.45+MIN(MAX(A1-43000,0),150000-43000)*0.4+MIN(A1-11000,43000-11000)*0.2+MAX((MIN(A1,122000)-100000)/2,0)*0.4,0) originally posted here by Fivecases] I split it into monthly and separated the individual tax rates. It seems to work.

20% tax =IF(MIN(C4-(O$6),(O$5-O$6))*0.2>0,MIN(C4-(O$6),(O$5-O$6))*0.2,0)

40% tax =MIN(MAX(C4-(O$5),0),(O$4-O$5))*0.4+MAX((MIN(C4,(O$4))-(O$7))/2,0)*E$3

45% tax =MAX(MAX(C4-(O$4),0)*F$3)

Hidden column B4:B15 days in month formulae to calculate "Period" dates

"Taxable income" does not take into account allowable tax deductions like employee pension contributions or blind person allowance. Sadly, it only works for regular incomes. I've yet to find a way to make it work on accrued incomes. For example if one month you work overtime and it takes you into the 40% tax band followed by a couple of months on reduced income resulting in previous 40% tax overpayments refunded. Maybe one day, I'll succeed.

National Insurance =IF(C4<=I4,0,IF(C4<=J4,(C4-I4)*10%,(J4-I4)*10%+((C4-J4)*2%)))

| Calculations_Income Tax_National Insurance.xlsx |

|---|

|

|---|

| A | | C | D | E | F | G | H | | | K | L | M | N | O |

|---|

| 1 | Monthly | | | | | | | | | | | | | | |

|---|

| 2 | | | Taxable | | Tax Payable | | Total | | | | National | Total | | | |

|---|

| 3 | Period | | Income | 20% | 40% | 45% | Tax | Check | | | Insurance | Stoppages | Remaining | | |

|---|

| 4 | 06/Apr/2024 | | 10,500.00 | 628.33 | 2,914.67 | 32.25 | 3,575.25 | 3,575.25 | | | 440.48 | 4,015.73 | 6,484.27 | 125140/12 | 10,428.33 |

|---|

| 5 | 06/May/2024 | | - | - | - | - | - | - | | | - | - | - | 50270/12 | 4,189.17 |

|---|

| 6 | 06/Jun/2024 | | 1,200.00 | 30.50 | - | - | 30.50 | 30.50 | | | 15.25 | 45.75 | 1,154.25 | 12570/12 | 1,047.50 |

|---|

| 7 | 06/Jul/2024 | | 2,000.00 | 190.50 | - | - | 190.50 | 190.50 | | | 95.25 | 285.75 | 1,714.25 | 100000/12 | 8,333.33 |

|---|

| 8 | 06/Aug/2024 | | 3,500.00 | 490.50 | - | - | 490.50 | 490.50 | | | 245.25 | 735.75 | 2,764.25 | | |

|---|

| 9 | 06/Sep/2024 | | 2,500.00 | 290.50 | - | - | 290.50 | 290.50 | | | 145.25 | 435.75 | 2,064.25 | | |

|---|

| 10 | 06/Oct/2024 | | 1,500.00 | 90.50 | - | - | 90.50 | 90.50 | | | 45.25 | 135.75 | 1,364.25 | | |

|---|

| 11 | 06/Nov/2024 | | 5,000.00 | 628.33 | 324.33 | - | 952.67 | 952.67 | | | 330.48 | 1,283.14 | 3,716.86 | | |

|---|

| 12 | 06/Dec/2024 | | 8,000.00 | 628.33 | 1,524.33 | - | 2,152.67 | 2,152.67 | | | 390.48 | 2,543.14 | 5,456.86 | | |

|---|

| 13 | 06/Jan/2025 | | 7,000.00 | 628.33 | 1,124.33 | - | 1,752.67 | 1,752.67 | | | 370.48 | 2,123.14 | 4,876.86 | | |

|---|

| 14 | 06/Feb/2025 | | 6,000.00 | 628.33 | 724.33 | - | 1,352.67 | 1,352.67 | | | 350.48 | 1,703.14 | 4,296.86 | | |

|---|

| 15 | 06/Mar/2025 | | 6,000.00 | 628.33 | 724.33 | - | 1,352.67 | 1,352.67 | | | 350.48 | 1,703.14 | 4,296.86 | | |

|---|

| 16 | | | | | | | | | | | | | | | |

|---|

| 17 | Total | | 53,200.00 | 4,862.50 | 7,336.33 | 32.25 | 12,231.08 | 12,231.08 | | | 2,779.11 | 15,010.19 | 38,189.81 | | |

|---|

|

|---|