Hi

SDLT

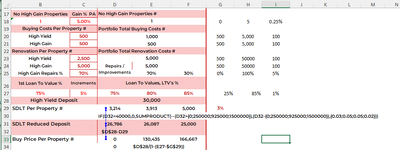

You have featured the UK Property Tax, SDLT, in earlier posts but the Calculations are for a fixed cost of Property.

Assuming a Cash Pot of £50,000 and a Mortgage of 75% of Value (LTV), except for the SDLT I could buy a £200,000 Property but I need to withold money to pay the SDLT.

Say the SDLT is 3% of the Buy Price, on £200,000 that is £6,000.

But if I reduce the Cash Pot by £6,000 to £44,000, the maximum Buy Price reduces to £176,000 at 75% LTV with a new SDLT liability at 3% or £5,280.

If the difference of £720 is added to the Deposit, I could increase the Buy Price by up to £2,880, less the increasing SDLT

Without using iteration how can I get an absolutely accurate calc? The code will be in an Online Calculator.

Thankyou David Humphreys

SDLT

You have featured the UK Property Tax, SDLT, in earlier posts but the Calculations are for a fixed cost of Property.

Assuming a Cash Pot of £50,000 and a Mortgage of 75% of Value (LTV), except for the SDLT I could buy a £200,000 Property but I need to withold money to pay the SDLT.

Say the SDLT is 3% of the Buy Price, on £200,000 that is £6,000.

But if I reduce the Cash Pot by £6,000 to £44,000, the maximum Buy Price reduces to £176,000 at 75% LTV with a new SDLT liability at 3% or £5,280.

If the difference of £720 is added to the Deposit, I could increase the Buy Price by up to £2,880, less the increasing SDLT

Without using iteration how can I get an absolutely accurate calc? The code will be in an Online Calculator.

Thankyou David Humphreys