Hello,

I've been searching and trying different formulas for some time and to no avail.

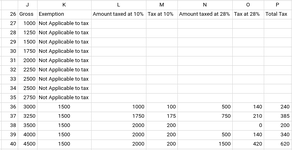

I want help with a ROUNDDOWN and maybe a MAX formula to calculate tax. So basically, the first $2,000 is taxed at 10%. $2,000.00 is the max that can be taxed at 10%.

e.g. if the tax overage is $1,500, then only $1,000 will be taxed at 10%, if its $2,500, only $2,000 will be taxed at 10%, if its $3,000, then only $2,000 will be taxed at 10%

So the formula would essentially, if the total is more than 2000, MAX 2000 but if it's less than 2000, then round down to $1000. Im using FLOOR and MAX but have no idea how to bring them together.

=IF(Y9<2000;IF(FLOOR(Y9;1000))) or =IF(Y9>2000;2000;Y7-Y9)

I've been searching and trying different formulas for some time and to no avail.

I want help with a ROUNDDOWN and maybe a MAX formula to calculate tax. So basically, the first $2,000 is taxed at 10%. $2,000.00 is the max that can be taxed at 10%.

e.g. if the tax overage is $1,500, then only $1,000 will be taxed at 10%, if its $2,500, only $2,000 will be taxed at 10%, if its $3,000, then only $2,000 will be taxed at 10%

So the formula would essentially, if the total is more than 2000, MAX 2000 but if it's less than 2000, then round down to $1000. Im using FLOOR and MAX but have no idea how to bring them together.

=IF(Y9<2000;IF(FLOOR(Y9;1000))) or =IF(Y9>2000;2000;Y7-Y9)

Last edited: