Hi there

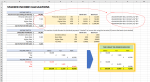

I am hoping someone can take pity on me and put me out of my misery? I have been trying to figure this out for hours! I am trying to get on top of my finances and want to make a "calculator" that can automatically work out out TAX DUE for PAYE & DIVIDENDS (both use different tax %). Hopefully this is obvious on the screen shot attached.

I have done this successfully for the first part eg assuming a £50k PAYE start, i have successfully worked out how to automatically work out the tax (please note that as i can't attach the excel file, i have shown the formula i have used in the attachment).

What i need to be able to do (and need help with) is to have a start point of £50k going into the second part (DIVIDEND section) and then allocate tax against the new income of £50k (for example) using the new tax % as shown in the figures. And it is here i just cannot work out what to do? I have tried lots of attempts but cannot get my head round how to approach this automatically (it is easy to manually do it - i have shown the answer ii am trying to achieve).

Please can someone put me out of my misery?

Best wishes

Mike

I am hoping someone can take pity on me and put me out of my misery? I have been trying to figure this out for hours! I am trying to get on top of my finances and want to make a "calculator" that can automatically work out out TAX DUE for PAYE & DIVIDENDS (both use different tax %). Hopefully this is obvious on the screen shot attached.

I have done this successfully for the first part eg assuming a £50k PAYE start, i have successfully worked out how to automatically work out the tax (please note that as i can't attach the excel file, i have shown the formula i have used in the attachment).

What i need to be able to do (and need help with) is to have a start point of £50k going into the second part (DIVIDEND section) and then allocate tax against the new income of £50k (for example) using the new tax % as shown in the figures. And it is here i just cannot work out what to do? I have tried lots of attempts but cannot get my head round how to approach this automatically (it is easy to manually do it - i have shown the answer ii am trying to achieve).

Please can someone put me out of my misery?

Best wishes

Mike